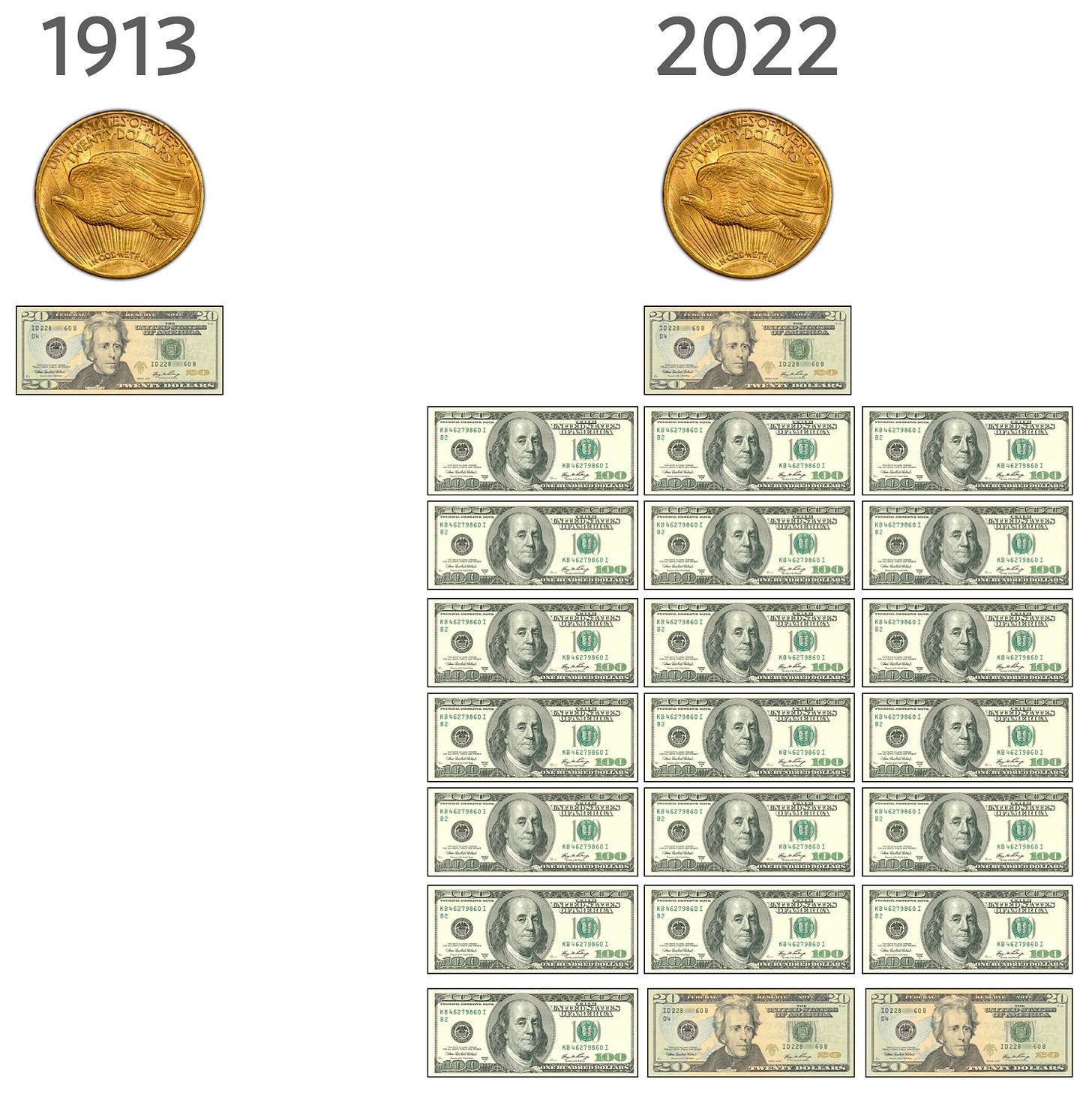

Gold is selling for around $1,960 an ounce. From 1849 to 1933 the U.S. Treasury issued one ounce gold coins for $20. You could trade $20 paper currency and one ounce gold coins back and forth. Then in 1933 Franklin Roosevelt issued Executive Order 6102 that required all persons to deliver their gold to the Federal Reserve Bank and be paid $20 in paper currency. Those who elected not to relinquish their gold could be fined $10,000 or ten years in prison or both. The government then offered to resell the gold for $35 and ounce. This represented a 42.85 percent devaluation of the paper dollar.

Paper currency held is value against gold for 84 years from 1849 to 1933. From 1933 to 2022 it lost 98.98 percent of its value. Although 445,500 specimens of the $20 gold coins were minted in 1933, none were ever officially circulated, and all but two were ordered to be melted down. One of the coins sold at auction in June 2021 for $18.8 million dollars.

The ability of governments to print infinite amounts of currency is one reason we prefer to use time as a measurement. As Ironman Tony Stark’s father tells him, “No amount of money ever bought a second of time.” You can print money but you can’t print time.

We prefer to use “time prices” instead of money prices. A time price is simply the money price divided by hourly income. Money prices are expressed in dollars and cents. Time prices are expressed in hours and minutes.

There are four reasons that time is a better way to measure than money. First, time prices contain more information than money prices. Since innovation lowers prices and increases wages, time prices more fully capture the benefits of valuable new knowledge. To just look at prices, without also looking at wages, only tells half the story. Time prices make it easier to see the whole picture.

Second, time prices transcend all of the complications associated with trying to convert nominal prices to real prices. Time prices avoid the subjective and disputed adjustments such as the Consumer Price Index (CPI), the GDP Deflator or Implicit Price Deflator (IPD), the Personal Consumption Expenditures price index (PCE), and Purchasing Power Parity (PPP). Time prices use the nominal price and the nominal hourly income at each point in time, so inflation adjustments are not necessary.

Third, time prices can be calculated on any product with any currency at any time and any place. This means you can compare the time price of bread in France in 1850 to the time price of oranges in New York in 2021. Analysts are also free to select from a variety of hourly income rates to use as the denominator to calculate time prices.

Fourth, time is an objective and universal constant. The International System of Units (SI) has established seven key metrics, of which six are bounded in one way or another by the passage of time. As the only irreversible element in the universe, with directionality imparted by thermodynamic entropy, time is the ultimate frame of reference for all measured values.

Time cannot be inflated or counterfeited. It is both fixed and continuous. Everyone has perfect time equality with 24 hours a day.

These four reasons make using time prices superior to using money prices for measuring resource abundance. They are really the true prices we pay for the things we buy in life.

You can learn more about these ideas in our forthcoming book, Superabundance, available for pre-order at Amazon.

Gale Pooley is a Senior Fellow at the Discovery Institute and a board member at Human Progress

Share this post