We’re All Billionaires Now

When someone creates a product based on knowledge, we can all use that product at the same time. It’s as if we all own the product.

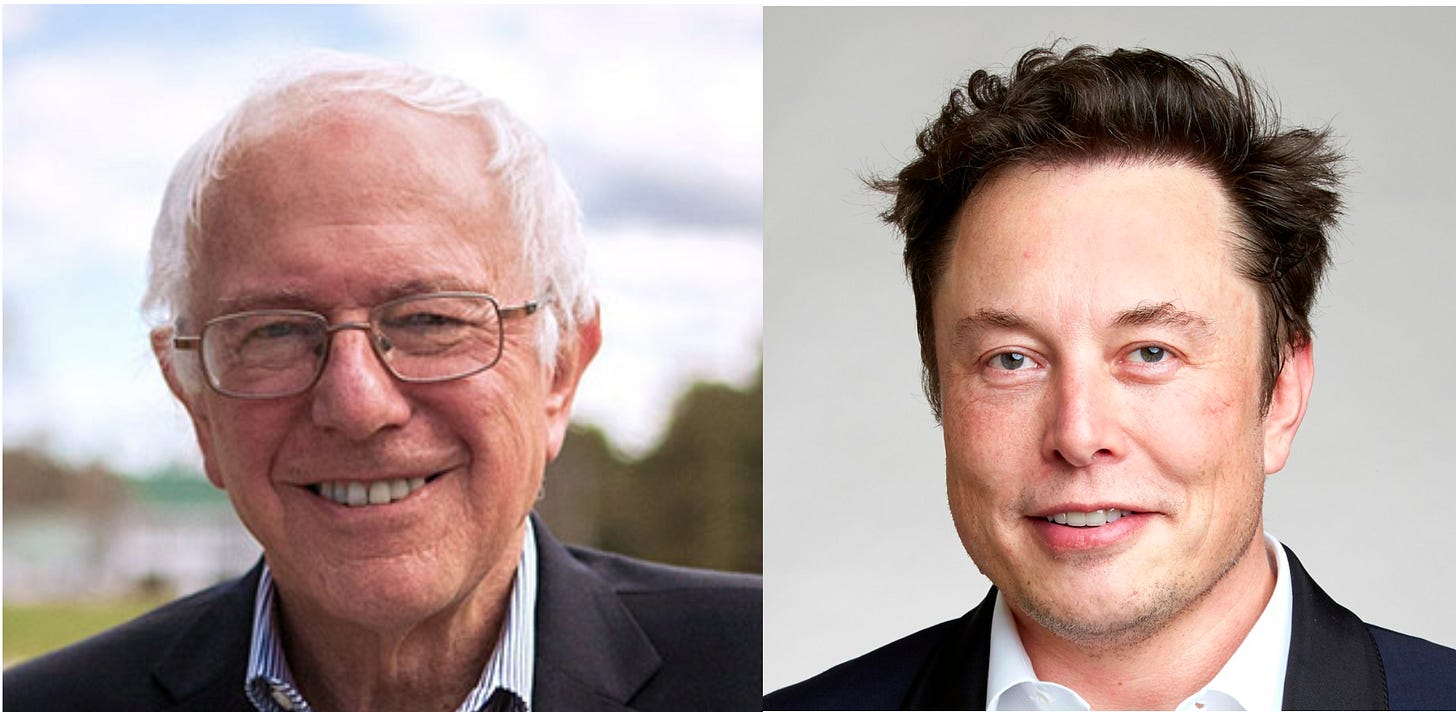

Senator Bernie Sanders has tweeted “There should be no billionaires.” Compared to 100 years ago, the U.S. is a country where everyone is a billionaire. We may not have a billion dollars in the bank but we enjoy the benefits of many billions of dollars invested on our behalf in the products and services we use every day. Let me explain.

Fixed Costs and Marginal Costs. In economics we think about the cost to create a new product and then the cost to manufacture each additional unit. Many products have high fixed costs but low per unit costs when manufactured at scale. This per unit cost is also called marginal cost. The marginal costs on some products can actually reach zero.

More People Makes Us All Richer. The reason we can enjoy products with such high fixed costs and low marginal costs is because there are so many of us. Creators of these high fixed products can recoup these costs over millions, if not billions of customers. Adam Smith understood this back in 1776. If you want to get rich, have lots of potential customers. Large markets also allow people to develop their skills and specialize in such things as drug and software development. The bigger the population and the more we specialize the more variety and lower costs we enjoy in the marketplace.

Here are five examples:

Movie Billionaires. The top ten highest grossing films cost a total of $2.8 billion to create. To enjoy all ten of these movies at the theater when they were released cost about $100. Today you can stream them at home on your $250, 55-inch large-screen high definition TV along with 1,900 other movies for around $9.99 a month on Disney+. Unskilled workers earn around $17.17 an hour today, so it takes around 14.5 hours to buy the TV and 35 minutes of work each month to enjoy this multi-billion dollar benefit.

iPhone Billionaires. It’s estimated that Apple spent $150 million over three years to develop the first iPhone released in 2007. It sold for $499. How could it be sold so cheap if it cost so much?

According to CNBC, Apple has sold over 2.3 billion iPhones and has over 1.5 billion active users. In 2009 Apple spent $1.33 billion on research and development and in 2024 they will spend over $32 billion. They have spent $208 billion on developing new products over the last 16 years. About half of Apple’s revenues come from iPhone sales. Assuming half of their research and development investment has gone into the iPhone we are enjoying a product that cost over $100 billion for around $30 a month, or around an hour and 45 minutes of work for a typical unskilled worker.

Note: In 2009 Amazon spent $1.24 billion on research and development, similar to Apple. This year they expect to spend over $85 billion. In the last 16 years they have spent $485 billion.

Medicine Billionaires. The cost to develop a new drug is estimated to range from less than $1 billion to more than $2 billion. The Congressional Budget Office notes that “Those estimates include the costs of both laboratory research and clinical trials of successful new drugs as well as expenditures on drugs that do not make it past the laboratory-development stage, that enter clinical trials but fail in those trials or are withdrawn by the drugmaker for business reasons, or that are not approved by the FDA.” Once a drug is approved the marginal cost can be very low, maybe under a dollar.

If it costs one billion dollars to develop a new drug but each new unit of the pill only costs a dollar, how much should you charge the customer for it? The answer depends on the size of the market. If the market is one thousand people your costs are going to be one billion dollars plus $1,000. You would have to sell each pill for one million dollars plus $1 to break even. If your market was a million people the breakeven price would drop to $1,001. If your market was a billion potential customers the price per pill drops to $2.00. This is why new drugs are typically developed for widespread medical conditions. The fixed costs must be spread across a sufficiently extensive market. This is pretty amazing when you think about it. You get a pill that required a billion dollars to develop for $2.00 if a billion other people have the same problem.

Book Billionaires The Harry Ransom Humanities Research Center estimates that before the invention of the printing press the total number of books in all of Europe was around 30,000. The United Nations Educational, Scientific and Cultural Organization estimates there are roughly 158,464,880 unique books in the world as of 2023.

When Gutenberg innovated printing in 1440 an average book cost around 135 days of labor ranging from 15 days for a short book to 256 days for a major work. Working eight hours a day an average book would cost 1,080 hours. Today blue-collar compensation (wages and benefits) is around $37.00 an hour. That would put the money price of a typical book at $40,000 if there had been no book innovation since 1439.

Google has become the new Gutenberg. They have a library of more than 10 million free books available for users to read and download. Assuming the average book is around 250 pages and a half-inch thick would mean you need a bookshelf around 80 miles long to hold this library.

Before Gutenberg and his press, Google and the internet, Amazon and their digital tablet, and the manufacture of computer memory chips it would cost $400 billion to have a 10 million volume library. It would take 5.4 million people working full time for a year to create this library in 1439.

Today you can have this library for around $43. That’s $35 for the tablet and $8 for the 2 TB memory stick. Another really valuable feature we enjoy today is being able to search for a word or phrase in any of these books.

Music Billionaires The original phonograph record was developed by Thomas Edison in 1877. Suddenly people did not have to be present at a live performance to hear music. In 1949, RCA Victor became the first label to roll out 45 RPM vinyl records and by the 1950s the price was around 65 cents each. Unskilled workers at the time were earning around 97 cents an hour. This would put the time price of a song at 40 minutes.

Steve Jobs introduced the iTunes Store on April 28, 2003 and sold songs for 99 cents. By this time unskilled wages had increased to $9.25 an hour. The time price of a song had dropped 84 percent to 6.42 minutes. Listeners in 2003 got six songs for the price of one in 1955.

Apple Music was launched on June 30, 2015. Today a student can get access to 90 million songs for $5.99 a month. Soundcloud is another popular music streaming service with over 320 million songs priced at $4.99 a month, or 18 minutes of time for an unskilled worker.

In 1955 the time to earn the money for an unskilled worker to buy the 320 million song Soundcloud catalog on 45 RPM records would have taken 106,666,667 hours. At today’s rate of $17.17 an hour it would cost $1,831,466,666.

Capitalist Billionaires Under capitalism the only way wealth can grow is if entrepreneurs create it in the form of new products and services. Becoming a billionaire is a byproduct of how successful a person is at creating and producing. When someone creates a product based on knowledge, it is non-rivalrous. Paul Romer won a Nobel prize in part for explaining this truth. It means we can all use that product at the same time. It’s as if we all own the product. Knowledge products make us all billionaires.

Bernie’s envy has blinded him to these economic truths. Telling America’s creators they don’t deserve to use their wealth to make the rest of us billionaires will return us to the Dark Ages of poverty and despair. Bernie really wants to expropriate capital from Elon and other innovators and give it to his fellow politicians and bureaucrats to lavish it on their friends and supporters. Once this capital is seized, however, entrepreneurs will be much less motivated to create any more. Ask all of the entrepreneurs that lived in the former Soviet Union, and those in China under Mao, how 100 percent taxation disincentivized them to ever create and take any risks.

If your 16-year old had earned $1,000 working at their first job and wanted to pick an investment advisor, whom would you recommend: Elon the creator or Bernie the expropriator?

Please consider enjoying our new course on the Economics of Human Flourishing at the Peterson Academy.

We explain and give hundreds of examples why more people with freedom means much more resource abundances for everyone in our book, Superabundance, available at Amazon.

Gale Pooley is a Senior Fellow at the Discovery Institute and a board member at Human Progress.

Yes, no… maybe

Love this work you do…to compare apples to apples…or rather records to mp3s