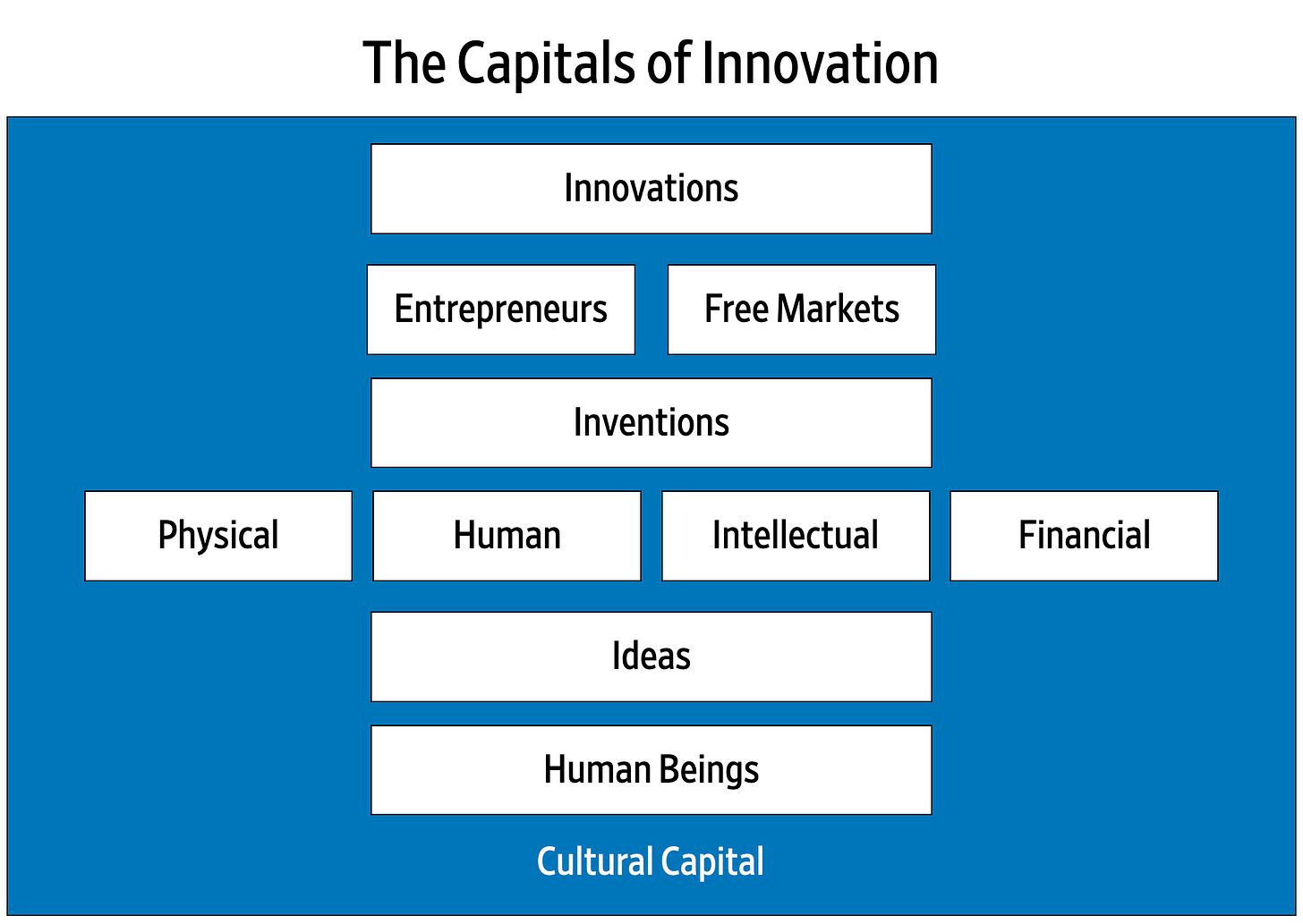

We know that all human progress depends on innovation. In this essay, we will explain the capitals of innovation, our framework for understanding how innovation works. Many economists and historians have contributed to our thinking about how human civilization makes progress through innovation. This illustration represents all of the elements of our innovation framework. We will discuss each element individually and show you how all of these capitals work together to create an innovative culture.

First a couple of definitions. What is wealth? Wealth is anything we value. We value all kinds of things, like gold or oil, or health or family, or money. Two of the most important things we value are time and knowledge. What is Economics? Economics is the study of how human beings create value for one another. What is capital? Capital is anything we can use to create value. There are many different types of capital so it’s always important to distinguish the category we’re talking about. To avoid confusion, we try to clarify our capitals.

The first capital in our framework is Human Beings. Many economists have written about this. Don Boudreaux and Julian Simon have noted that the human mind is the ultimate resource because it, and only it, creates all of the other economically valuable inputs that we call resources by discovering and creating new knowledge. Simon also noted that the human population had to reach a critical mass, and urban density, and degree of freedom before humanity could enter the Age of Innovation and escape absolute poverty. Simon also agreed with Adam Smith that larger populations create larger markets, which can absorb the high fixed costs associated with many innovations. Larger populations, Smith observed, also allow for more specialization and production of niche products.

The next capital in our framework is Cultural Capital. We draw cultural capital as a large blue area because it serves as a base or foundation state in our framework. All of our other capitals depend on the strength of a country's cultural capital. Different countries have different cultures. Culture is how people treat each other. A country's culture is determined in large part by the worldview of its leaders. Worldview determines the political system, the political system will determine the legal system, and the legal system will determine the economic system.

For example, the Korean peninsula had the same language, geography, and natural resources. In the early 1950s, a war split the peninsula into North and South Korea. Both countries have been led by leaders with dramatically different world views. After the war, GDP per capita was actually higher in the north than the south. Now when you view it from a satellite, they look like night and day. Today GDP per capita in South Korea is 25 times greater than North Korea.

Cultures that have developed the institutions of private property and rule of law have advanced much faster than those who haven’t. The ideal of the Rule of law is a system of equality before the law, where disinterested judges enforce contracts and judgment is issued based on the weight of the evidence, not the status of the parties. All members of society must submit to the Rule of Law, including the King. No country has perfect rule of law, but some countries have pursued this ideal more successfully than others, and their economic growth reflects this progress. Countries have different degrees of freedom and levels of trust between people. Elections, a free press, and rights to speech are all part of a culture. Countries where people trust and respect and value one another, and enjoy the freedom to express their ideas and create and share their inventions have a high level of cultural capital.

The next element in our framework is Ideas. An idea is a thought about how to potentially create new value. Only human beings have ideas. The culture influences how frequently people have ideas and if they can share and act on their ideas. Ideas are typically about how to combine capitals in new ways that can create value.

The next capital we consider is Physical Capital. This category of capital includes the atoms and energy of our planet. We call these natural resources, but as Don Boudreaux has noted, “It’s true that nature created materials, but nature did not transform them into resources. This all-important transformation was the product exclusively of human creativity, intellect, and effort.” Time is also considered physical capital, perhaps the most important physical capital. We will come back to time when we talk about money. Physical capital shows up in our buildings and equipment and everything that we touch. Physical capital is also expressed in machines that make things.

Our next capital is Human Capital. Human capital is what you and I possess. It includes trust, and health, skills, knowledge and know-how, and our personalities and relationships with others. Trust is a key human capital. There are two types of trust: integrity and competence. Warren Buffett said, “I look for three things in hiring people. The first is personal integrity, the second is intelligence, and the third is a high energy level. But if you don’t have the first, the other two will kill you.”

The next capital is Intellectual Capital. This would include the knowledge we’ve collected and made accessible to others. Also included in this category are technology, methods, and patents. Some have argued that patents are the key to innovation. The U.S. Constitution includes a section on patents. The U.S. has issued over ten million patents. Patent number 265,311 was issued on October 3, 1882 to Thomas Edison for the light bulb.

The next capital is Financial Capital. Finance is money put at risk over time. A key principle is that money is time. As we have noted, we buy things with money, but we pay for them with time. A financial system requires people willing to save and loan their money to others. Stable currencies are key as well. If an economy is suffering from monetary inflation, savers disappear, along with the commitment to long-term investment. We also include insurance under this category. The development of insurance was a key innovation that allowed us to take on much larger risks by diversifying across many small risk-takers. In addition, we include the limited liability corporation as another key innovation. This also allowed us to raise large amounts of financial capital to fund immense and risky projects by creating opportunities for many shareholders to invest, with losses limited to the size of their appetite for risk. Double entry accounting is also considered a financial innovation. This system of measuring allows for a standardized way of comparing company performance. All of these financial innovations have made creating value much easier and less risky for individuals.

An invention is the proof of an idea. It is turning a thought into reality. But an invention is not an innovation. In order for an invention to become an innovation it must pass through the gauntlet of the market. Individuals who take inventions to the market are entrepreneurs. They take risks in an effort to see if value has been created. They are trying to determine if inventions are really innovations. In order for entrepreneurs to serve an economy they must be free to discover and learn. A key element in the process is failure. Entrepreneurs must be willing to fail in their search for value. A society that honors entrepreneurs will enjoy the prosperity that comes with new innovations. Societies stagnate if they look down on entrepreneurs, business owners, and merchants. A key to China’s emergence from poverty was an elevation of the social status of its entrepreneurs.

Entrepreneurs must have free markets. A free market is where buyers and sellers discover value. It’s a place where we can go to solve each other’s problems using a price system. Markets are really information systems that create incentives. When markets are restricted, and prices are controlled by governments, discovering knowledge is prevented, which is the key to wealth creation and innovation.

An innovation is a profitable or market-successful invention. Everyone participating in a market assigns value to things. Buyers and sellers trade when there is a difference between price and their values. Every trade is one price and two values. The price must create value for both parties for a trade to occur.

In review, our framework starts with human beings who function in cultures. Only human beings have ideas. Ideas are thoughts about potential value. We use physical, human, intellectual, and financial capital to convert our thoughts into inventions. Inventions must be taken to markets by entrepreneurs to be tested for value. An innovation is a profitable invention. Innovations provide new feedback into the system creating even more new ideas.

We create value for one another by continuously innovating our capitals. A society with all of these capitals working and cooperating together will create innovations and escape poverty. The growth of one type of capital typically encourages the growth of other capitals. Free and creative human beings and an open and trusting culture are the key foundations to innovation.

You can learn more about these ideas in our forthcoming book, Superabundance, available for pre-order at Amazon.

Gale Pooley is a Senior Fellow at the Discovery Institute and a board member at Human Progress

Share this post