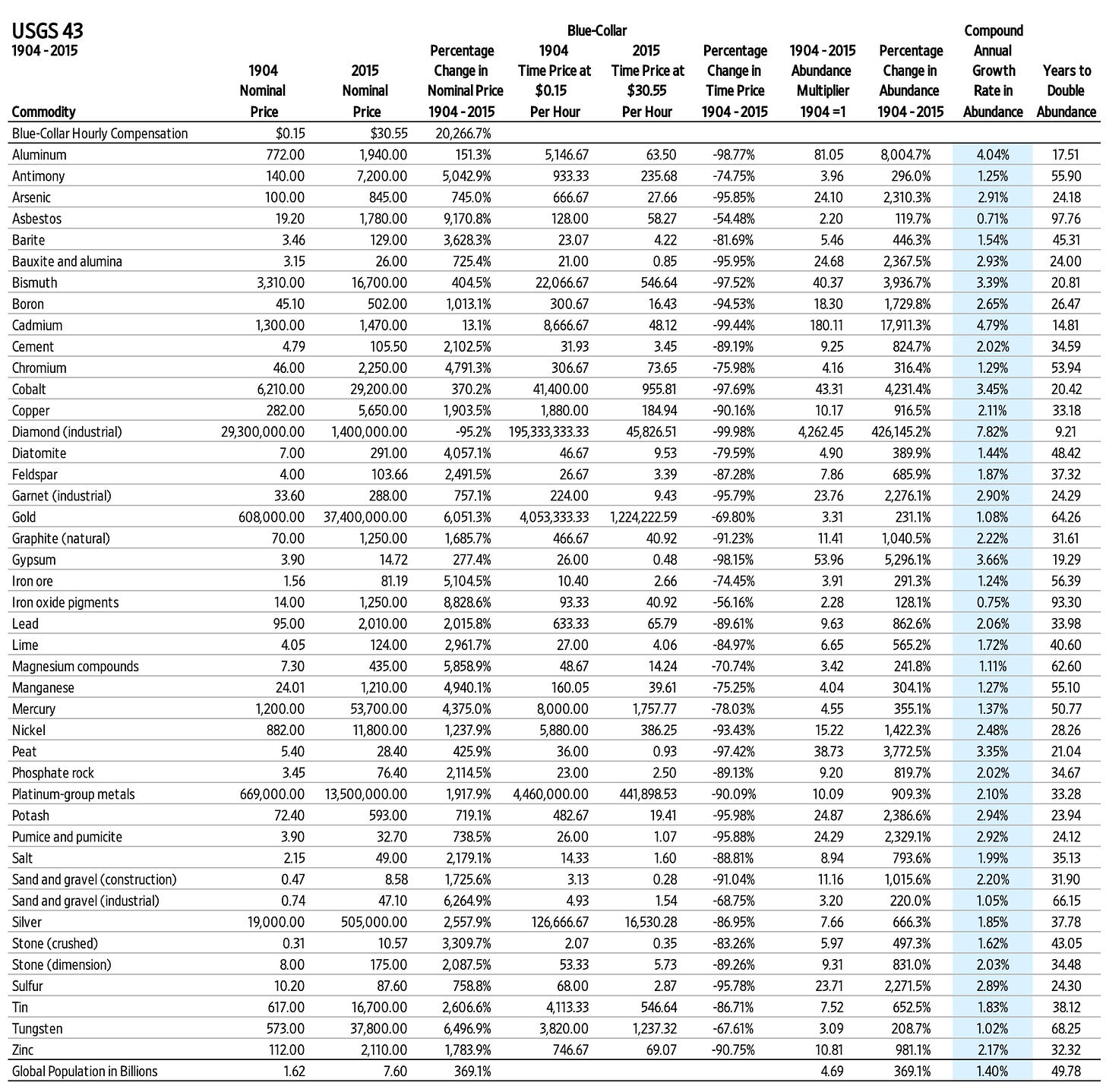

The United States Geological Survey (USGS) tracks prices on a variety of minerals and metals ranging from aluminum to zinc. We have analyzed 43 of these items over a 111-year period from 1904 to 2015. The nominal prices were converted to time prices using blue-collar hourly compensation (wages and benefits) data from measuringworth.com. We found that all 43 items have become more abundant, ranging from a 119.7 percent increase for asbestos to a 426,145 percent increase for industrial diamonds. The median growth was around 831 percent, or 2.03 percent compounded annually.

The time price of industrial diamonds became the most abundant, falling by 99.98 percent. For the time required to earn the money to buy one of these diamonds in 1904, you would get 4,262 diamonds in 2015. Industrial diamond abundance increased at a 7.82 percent compound annual rate. With this growth in abundance, diamonds have truly become one of industry’s best friends.

This growth in mineral and metal abundance occurred at the same time global population increased 369.1 percent from 1.62 billion to 7.6 billion, indicating a compound annual rate of around 1.4 percent.

Julian Simon observed that the more we use of these non-renewable resources, the more we find. The evidence strongly supports the Simon theorem.

Our growth in “non-renewable” metal and mineral abundance is increasing much faster than our growth in population. Reusability is the key characteristic of these items.

You can learn more about these findings in our forthcoming book, Superabundance, available for pre-order at Amazon.

Gale Pooley is a Senior Fellow at the Discovery Institute and a board member at Human Progress

Share this post