Housing Abundance

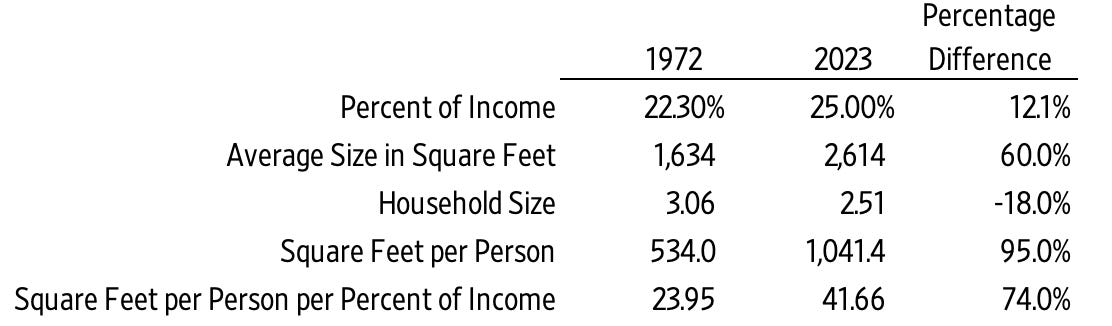

Compared to the early 1970s, we get 74 percent more square feet of housing per person, per percent of household income.

The Bureau of Labor Statistics (BLS) conducts consumer expenditure surveys collecting data on a wide variety of products and services.

Over the past 50 years, the percent of household income spent on food fell 30 percent, and clothing dropped 64.9 percent, yet housing increased by 12.1 percent. What explains this rise? At least six key differences between homes in the early 1970s and 2023 help account for the change:

Size: The average home in 1972 measured 1,634 square feet, compared to 2,614 square feet in 2023—a 60 percent increase (980 additional square feet).

Household Size: Average household size declined from 3.06 persons in 1972 to 2.51 in 2023, an 18 percent decrease. We're buying more house per person.

In 1972, the average living space per person was 534 square feet; by 2023, it had nearly doubled to 1,041.4 square feet. In terms of affordability, one percent of household income bought 23.95 square feet of housing in 1972, compared to 41.66 square feet in 2023. We’re getting 74 percent more housing per person for the same share of income.

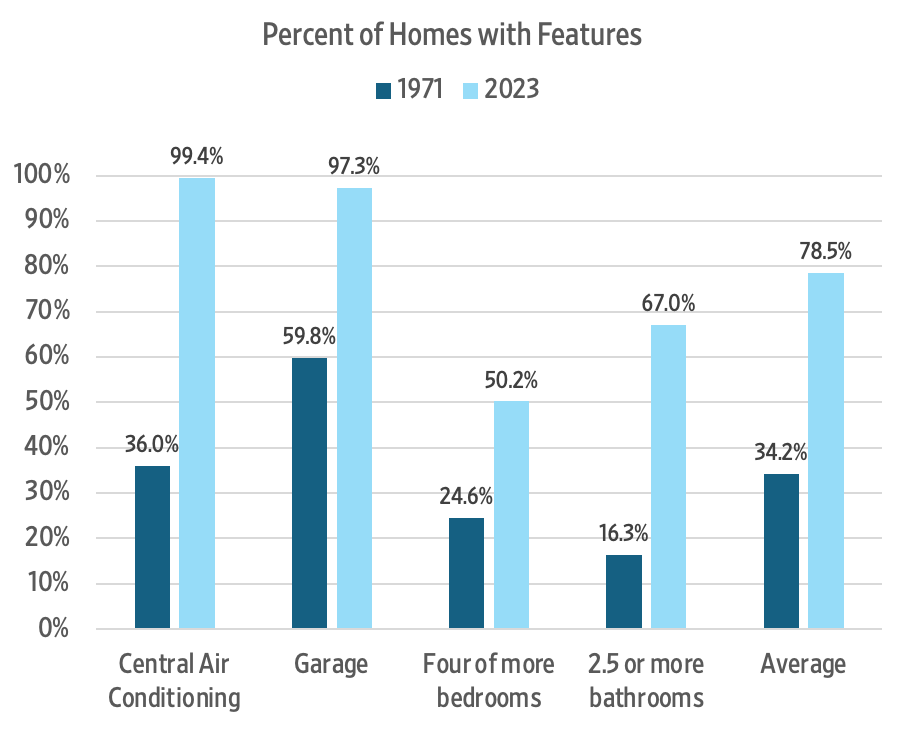

Four other factors also explain the difference:

Air Conditioning: In 1971, only 36 percent of homes had central air; by 2023, that number had reached 99.4 percent.

Garages: The share of homes with garages rose from 59.8 percent in 1971 to 97.3 percent in 2023.

Bedrooms: In 1971, only 24.6 percent of homes had four or more bedrooms; in 2023, 50.2 percent did.

Bathrooms: The percentage of homes with 2.5 or more bathrooms increased from 16.3 percent in 1971 to 67 percent in 2023.

After adjusting for increased square footage and smaller household size, the share of household income spent on housing falls to 14.3 percent. If we further account for improvements—such as the addition of air conditioning, garages, extra bedrooms, and bathrooms—a modest 25 percent quality adjustment brings the rate closer to 10.7 percent. In effect, we're now spending less than half as much of our household income on basic housing compared to the early 1970s.

We also see this phenomenon clearly when comparing automobiles from the early 1970s to those of today. While both have four wheels, modern cars deliver vastly superior fuel efficiency, comfort, safety, reliability, and performance.

The real question is: how much would someone have to pay you to trade your 2023 home and 2023 car for their 1972 counterparts?

Tip of the Hat: Jeremy Horpendahl

Learn more about our infinitely bountiful planet at superabundance.com. We explain and give hundreds of examples why more people with freedom means much more resource abundances for everyone in our book, Superabundance, available at Amazon.

Gale Pooley is a Senior Fellow at the Discovery Institute, an Adjunct Scholar at the Cato Institute, and a board member at Human Progress. He has also held the MAI, SRA, CCIM, and FRICS professional designations in real estate valuation and analysis.

This puts the issue of housing affordability into perspective. However, I'm surprised you did not mention a major cause of elevated house prices -- the failure to build due to numerous legal and regulatory restrictions.

I live in a 5000 SQFT house in the exurbs. A quick look at the builders invoice would explain all this.

Land, taxes, and other fixed expenses made up a majority of my houses cost.

Material and labor made up a substantial minority.

Additional square feet cost substantially less per square feet as the number of square feet increased.

As such, building a 1,500 SQFT home vs a 5,000 SQFT home really wouldn't cost that much difference.

So what we find amongst builders is that they are going to the nearest plot of untouched land available (whether inner, outer, or exurbs based on the situation in the local city) and mass building some master planned community.

In my own case there are twenty homes. Four of them have young children in the homes (these are 5,000 SQFT homes BTW). Sixteen of them have retired childless boomers living in them. Because those are the only people that can afford real estate and they sell their urban homes and buy something "in the country".

I know a lot of other young people starting families that don't do as well as me (and more critically, didn't own real estate before 2021). They can't afford shit. It's not even remotely possible. And all their jobs are way out of the commuting range of buying one of these exurban McMansions.